Understand Billing & Payments

Get quick, clear answers to your questions about billing, payments, insurance and more. If you don't see your billing questions answered below, please call (877) 629-2999. You may contact us from 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

Find answers to frequently asked questions below.

Registration & Admissions

Why do I have to verify my address each time I come in?

Though address and telephone numbers remain a constant for many of us, verifying this information helps make sure your bills are sent to the correct place so you can review them, contact us with any questions or concerns and pay any balance due.

Why do I have to show my insurance card if I already have in the past?

Insurance coverage changes more frequently than addresses. Your card provides telephone numbers, the claims address and group numbers essential for us to process your insurance claim in a timely manner. As an industry standard, insurance information is considered accurate only at the time of service, which is why we ask for it each time you are seen.

What is pre-registration?

Pre-registration is registering before the date a service or procedure is scheduled to happen. Pre-registration saves time and can make your visit to Sanford easier. Pre-registration may not be available depending on location and type of service or procedure.

What is the pre-registration process?

You will be asked a series of questions, including questions about insurance to help us process bills quickly and accurately. This information will be kept confidential. Pre-payment may also be needed.

What should I expect during registration/admission?

On the day of your admission, be sure to bring your insurance card or a copy of the front and back of the card with you that day. You will be asked to provide the following information: physician name; your legal name; sex; current address; phone number; employer; name of relative or other contact; and insurance information. You will be informed of any account balances and asked for any copayments due.

What is authorization/pre-authorization?

Authorization, pre-authorization or an insurance referral is often needed to confirm that a procedure or service is covered by your insurance plan. We recommend you contact your insurance carrier before scheduling a procedure so you are familiar with your benefits and the extent of your medical coverage.

Billing

When should I expect to receive a bill?

If there's a balance left after your insurance company has paid for covered services, you may get a bill. Insurance claims are billed by Sanford Health on a daily basis and are typically processed by insurance carriers within 30-60 days. If your insurance carrier requires additional information or denies the initial claim, an appeal process may delay your billing.

Why am I getting a bill now, when services were provided so long ago?

Sanford Health will process and send a patient billing statement after payment is received from the insurance carrier and it is confirmed that the balance is owed by the patient. The length of this process depends on how long it takes to receive a response from your insurance carrier. Upon certain denials from your insurance carrier, Sanford may also file an appeal with your insurance to attempt to secure payment for the services provided.

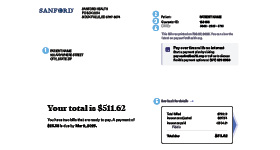

How do I read my bill?

What if I don't understand my bill?

Sanford has account representatives available to help you understand your billing statement. Please call (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

Why did I receive more than one bill?

As a large health system, Sanford providers may have offices located in different regions, which may require separate billing statements. For more information, please call (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

I think my bill was already paid. What can I do about that?

My Sanford Chart users can log in to view a real-time status of your balance by visiting the 'Billing' tab. You can also call Patient Financial Services at (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

What if there is a mistake on my bill?

Patient Account representatives are available to review your account to help resolve any mistakes on your bill. Please call (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

How can I pay my bill?

Sanford offers several easy and safe options to pay your bill. If you are unable to pay your entire balance at one time, you may have options to set up a payment plan. For assistance in making a payment or setting up a payment plan, or if you need more information, please call (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

Which payment methods do you accept?

Sanford accepts cash (in person), personal checks (or 'e-checks' if made online or by phone) and most major debit/credit cards, including MasterCard, Visa, American Express and Discover. To discuss other payment options, call (877) 629-2999.

If you cannot pay your bill or pay your bill in full, you may set up a payment plan or request financial assistance. Please contact Patient Financial Services at (877) 629-2999 for more information. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

Why do I keep receiving bills?

A new account is created for each date of service and the bill may be for a different date of service. Or, your payment may not have posted to your account before the next statement was generated and mailed. To determine if there is a balance, please view your billing information at mysanfordchart.org or contact Patient Financial Services at (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

My insurance should have paid my bill. What should I do?

Please verify that your insurance carrier has received and processed the claim. If the claim was received but has not been processed, then carefully review your insurance policy or contact your insurance carrier to determine if the services and procedures are covered. Your insurance carrier will have the most accurate and up-to-date information about your policy and your claim. If your insurance company has questions, please direct them to contact Sanford Patient Financial Services at (877) 629-2999. You may also contact Sanford at (877) 629-2999 to verify that the most up-to-date insurance information is on file. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

Why did I receive a bill from a doctor I did not see?

Hospitals often consult with specialized doctors as part of caring for patients. Often these specialists are sent items such as lab tests or x-rays for their expert review.

I have 100% coverage of preventive services. Why am I getting a bill for my preventive exam?

Sometimes while providing preventive services, an underlying health issue is discovered. When that happens, the service becomes medical, as opposed to preventive, in nature. The claim is then processed by your insurance company using your medical benefits.

What if my hospitalization is the result of an accident?

If you had a non-work-related accident, we will ask you for information about other insurance, like car insurance. If your accident or illness is work-related, we will bill your employer's workers' compensation program. It is important that you fill out the necessary paperwork or you could be responsible for the balance.

What is a hospital-based clinic and does that affect the amount I must pay?

Sanford Health has designated certain clinics as hospital-based-clinics. A hospital-based-clinic is a facility similar to a physician's office. The clinic provides diagnostic, preventive, curative, and rehabilitation services. The services are provided by an employed physician; however, the clinic is owned and operated by the hospital. Some insurance companies view this type of service as an outpatient clinic visit. You may incur a facility charge that may be assigned as a patient's co-payment responsibility. This kind of charge may not typically be incurred if the clinic were not considered hospital-based.

Why does health care cost so much?

The answer is complex. As with any business, hospitals must attempt to cover their expenses by charging for their services. But with hospitals the cost of providing services includes many necessary and costly items that do not readily come to mind when most of us think about our care. We take it for granted that the hospital is there 24 hours a day, 7 days a week. Likewise, we have come to expect that hospitals will have all of the latest technology that could possibly be needed for our care. And we expect that the people caring for us are highly trained, highly skilled professionals. Finally, although we seldom think about it, the cost to collect from insurance companies, the underinsured, uninsured and indigent population increased demand of consumption of health care services contribute to the cost.

We at Sanford Health regularly review our costs and pricing structure because we believe we must be leaders in getting health care costs under control, not only to support our customers' needs but also to improve upon the existing system of health care financing and delivery of care.

Why can't I inquire about a statement if I am not the patient or guarantor

Due to the HIPAA Privacy Act, we are only allowed to discuss account information with the patient or guarantor. If a patient has established a password, anyone knowledgeable of the password can have access to that information.

Insurance & Claims

How does health insurance billing work?

As a courtesy to our patients, when you receive services at Sanford Health, we bill your insurance carrier directly. To be sure the claim is properly submitted, we need a copy of your insurance card. HIPAA regulations require that we supply insurance carrier's complete information on the person that carries the coverage. This includes the name, address, phone number, date of birth and social security number. Incomplete information could mean a denial from your insurance carrier. When your insurance carrier delays, denies or makes partial payment, you are responsible for the balance.

Any additional patient financial responsibility is due by the due date on your patient billing statement. You may receive more than one statement for services rendered at Sanford Health.

If you receive a patient billing statement and do not understand the content, or if you believe that the information may be incorrect, please contact Patient Financial Services at (877) 629-2999. Our office hours are 7 a.m.-6 p.m. Monday-Thursday and 7 a.m.-5 p.m. on Friday.

What does it mean to be out-of-network?

Out-of-network refers to a patient seeking care outside the network of doctors, hospitals or other health care providers that the insurance company has contracted with to provide care. It usually applies to health maintenance organizations (HMOs) and preferred provider organizations (PPOs).

Did my insurance carrier pay for services?

Any payment made by your insurance carrier will be reflected on your patient billing statement. In addition, your insurance carrier will send, directly to you, an explanation of benefits (EOB) that details how your medical claim was processed and paid according to the benefit structure of your health insurance plan. This EOB will also indicate the patient due amount resulting from the payment of the listed services.

Why didn't my insurance carrier pay for services?

If your claim is denied, you should contact your insurance carrier directly for an explanation about how your claim was processed.

My insurance coverage has changed. What should I do?

To ensure prompt payment of your claim, please provide Sanford with your most up-to-date insurance card. Always take your insurance card with you to your appointments and make sure your health care providers have your current insurance information. If your insurance information has changed, you may provide that updated information to a representative by calling Patient Financial Services at (877) 629-2999. You may also send a copy of the updated insurance card to Sanford Health, P.O. Box 5074, Sioux Falls, SD 57117 or fax to our secure fax number at (605) 328-8311.

I am retired and have Medicare. Why do you ask about my and my spouse's employment status?

Medicare is a 'last payer insurance.' Federal law mandates that all Medicare providers complete the Medicare Secondary Payer (MSP) Questionnaire to verify at each visit that you or your spouse does not have an Employer Group Health Plan that would be primary over Medicare. When audited, we have to show proof that for each time you received services, you were asked specific questions relating to the possibility of other insurance. Additionally, if you are in an accident and someone else is at fault, the other party is responsible for your medical expenses according to federal law.